hai leute,

aufgrund des immer noch nicht komplett verarbeiteten traumas vom letzten oktober 'dank' dem crash in aktien / rohstoffen / eigenem portfolio / realwirtschaft / usw. habe ich mir in der letzten zeit des öfteren gedanken gemacht, ob es dieses jahr wieder so ähnlich laufen würde ... und ob jetzt der zeitpkt wäre, wo ich alle meine positionen auflösen sollte und in cash (reimt sich auf crash!) gehen sollte :o)

na ja, ich bin rein fundamental orientierter investor und so wie ich die welt sehe, steuern wir auf eine

(hyper-)inflationäre rally in harten vermögenswerten (~sachwerten) zu und ich glaube auch nicht, daß die haupttreiber dieser inflation, also die hoffnungslos überschuldeten (westlichen) regierungen und ihre kleinen, dreckigen, korrupten zentralbanken in naher zukunft das ruder herumreißen möchten u. einen anderen kurs einschlagen werden ...

daß jetzt nach wochenlangem freien fall der USD ggü. seinem papier-kumpel €uro etwas stärker wurde und viele rohstoffe und rohstoffaktien doch schon verdammt schlimme kurseinbrüche erlebt haben, ändert meine weltanschauung jetzt auch nicht wirklich :-).

ok, somit bleibe ich bei meinen gold- / silber- / rohstoffpositionen drin u. schaue zu, was kommt! immerhin dürfte es diesmal keine großen liquiditätsgetriebenen zwangsverkäufe wie im oktober 2008 geben, dafür haben unsere inflationisten [~gelddrucker] genügend kohle in die finanzbranche gepumpt, oder? ob ich mit meiner entscheidung glück / recht haben werde, wird sich sicherlich bald zeigen, wollen wir doch das beste 4 mein portfolio hoffen, stimmt's?

frage des tages: sehen die chartisten aus der be24-community irgendwelche ein-/ausstiegssignale? und sehen die anderen fundamentalisten noch paar weitere wesentliche punkte, die ich (noch) nicht erkannt habe?

btw, in meinem

blogbeitrag auf informedtrades.com habe ich heute die meinung von jim rogers (gemäß jack schwager's interview aus'm jahr 1988) zu chartanalyse ergänzt, vielleicht ist es für einige interessant, was die 3 dort erwähnten ausnahme-trader über chartanalyse gesagt haben :-)

folks, IMHO is

larry williams both, a technically based trader who uses the daily bar charts to identify his entry + exit points and a person, who calls the most chart patterns and the most technical indicators mumbo jumbo or the like ...

i hope it helps a lot! at least will my blog here start with a posting about a super duper commodity + futures trader :-)

greetings from munich,

jaro

addendum oct 21, 2009 => bruce kovnerfolks, i do actually read my InformedPoints hunt prize - jack schwager's market wizards and look: larry williams is not the only top trader who considers technical analysis mumbo jumbo :-)

bruce kovner also is! "technical analysis, i think, has a great deal that is right and a great deal that is mumbo jumbo."

well, why mumbo jumbo? ... "technical analysis tracks the past; it does not predict the future" ... he urges the readers 2 "use their own intelligence 2 draw conclusions about what the past activity of some traders may say about the future activity of other traders."

ok, and why is technical analysis also right? "technical analysis reflects the vote of the entire marketplace and, therefore, does pick up unusual behavior."

...addendum oct 27, 2009 => jim rogershell, is there any top trader who believes in technical analysis out there? do u know what did jim rogers answer 2 the question what is his opinion about chart reading? "i haven't met a rich technician. excluding, of course, technicians who sell their technical services and make a lot of money."

well, he still uses charts himself .... "yes, i look them every week. i use them for knowledge, to see what is going on. i learn a lot about what is going on in the world by looking charts. ... i look at charts to see what HAS HAPPENED."

=> watch out! die inflationary monster out there :-) ... btw, do you have enough gold, silver, real estate, farm land, picasso on the wall and all the other hard assets ALREADY?

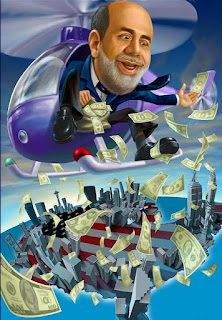

=> watch out! die inflationary monster out there :-) ... btw, do you have enough gold, silver, real estate, farm land, picasso on the wall and all the other hard assets ALREADY? the european money-printer (ECB) are not any better than ben bernanke :-(. btw, bernanke's helicopter can't avoid recession and in reality he would need many B52 bomber to dispose all that money he already added to the system :(

the european money-printer (ECB) are not any better than ben bernanke :-(. btw, bernanke's helicopter can't avoid recession and in reality he would need many B52 bomber to dispose all that money he already added to the system :(

.jpg)